Fixed Annuities vs. CD’s

If you’re seeking a safe and reliable way to grow your savings, fixed annuities often offer key advantages over traditional bank CDs.

With higher interest rates, tax-deferred growth, and the option to convert your savings into guaranteed lifetime income, fixed annuities provide greater long-term value and financial flexibility. Whether you’re nearing retirement or simply want more from your savings, a fixed annuity can deliver both security and stronger growth potential—without the risk of market loss.

Why a Fixed Annuity is Better Than a CD

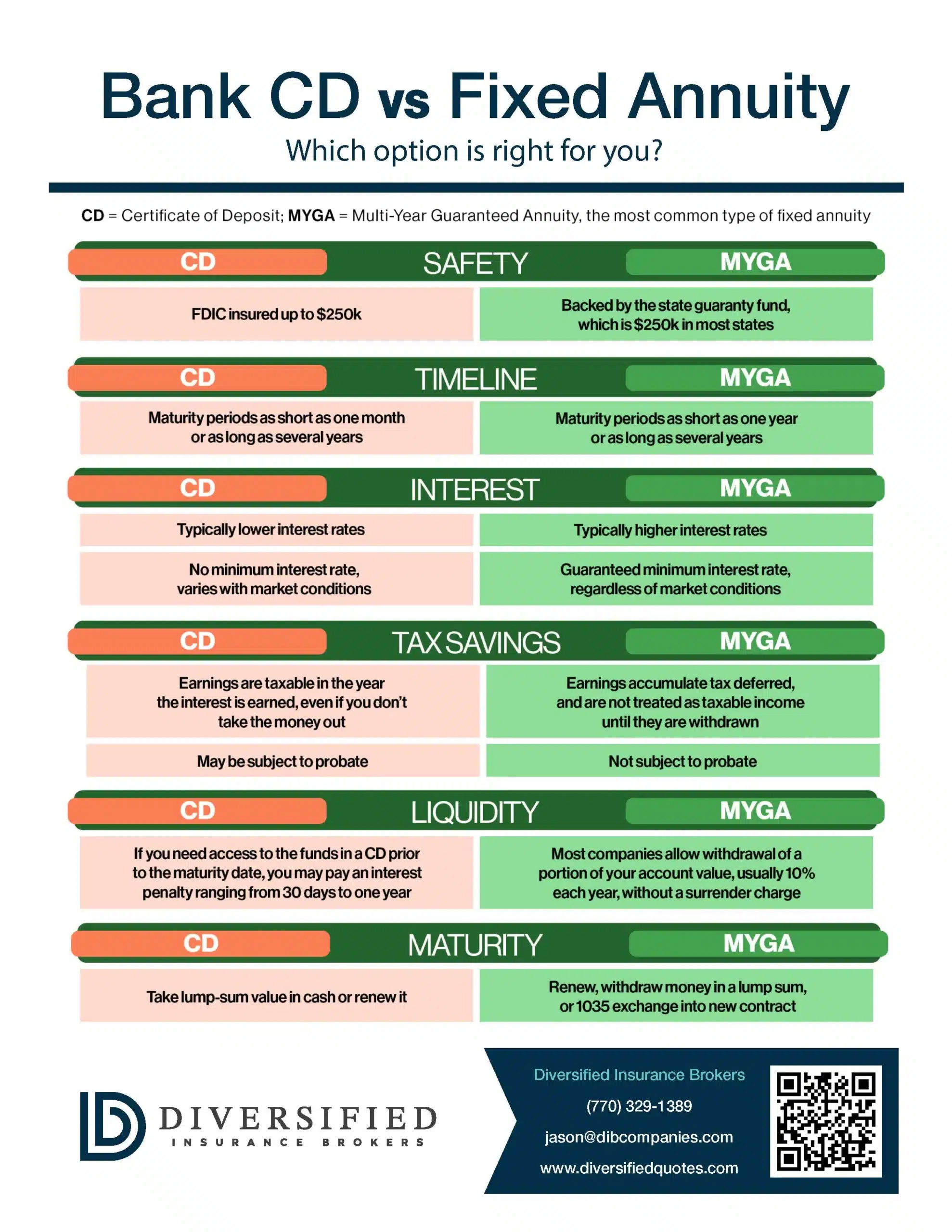

Both fixed annuities and certificates of deposit (CDs) appeal to conservative investors who prioritize security and guaranteed growth. While they share similarities, fixed annuities often deliver greater long-term value—especially for retirement-focused savers.

Fixed annuities typically offer higher interest rates than CDs, along with tax-deferred growth, meaning your money compounds faster without annual taxation. Additionally, fixed annuities provide the unique ability to convert your savings into guaranteed lifetime income—something CDs simply can’t offer. For investors looking to protect principal while maximizing retirement income, fixed annuities offer clear and compelling advantages over traditional bank CDs.

-

One of the key advantages of fixed annuities over CDs is their consistently higher interest rates—especially on longer-term contracts. While both options offer principal protection, fixed annuities typically provide better yields, allowing your money to grow more efficiently over time. This enhanced growth potential, combined with guaranteed returns, makes fixed annuities a stronger choice for conservative savers looking to maximize their earnings without taking on market risk.

Ideal Situations for Choosing a Fixed Annuity Over a CD

-

If you want more than just a lump-sum return, fixed annuities offer the option to convert your savings into guaranteed income for life—something CDs can’t provide.

📈 Want to See Today’s Top Annuity Rates?

Explore the most competitive fixed and bonus annuity rates available now.

👉 Check Current Annuity Rates

No Obligation Consultation

Why Fixed Annuities Outperform CDs for Long-Term Security

Certificates of deposit (CDs) offer short-term stability—but when it comes to building lasting financial security, fixed annuities provide significantly more. With higher growth potential, tax-deferred compounding, and the option for guaranteed lifetime income, fixed annuities deliver a more powerful solution for retirement planning and wealth preservation.

Whether you’re seeking predictable income or protection from market volatility, a fixed annuity offers long-term value that CDs simply can’t match.

Contact Us today to discover how a fixed annuity can work harder for your retirement.

Discover Your Portfolio Risk—Before the Market Does

Use our Risk Analyzer Tool to uncover hidden vulnerabilities in your current portfolio. Don’t assume your investments are safe—learn your true risk tolerance and take control. Gain clarity, reduce exposure, and protect your retirement from unnecessary market losses.

One Click Away from Coverage — Get a Quote or Apply Today for Life Insurance, Annuities, Medicare & More

From instant term life to guaranteed issue policies, fixed annuities to Medicare supplements, we make it easy to compare top-rated options and apply online in minutes. Whether you’re planning for retirement, protecting your family, or exploring long-term care coverage, you’re just one click away from customized protection.

FAQs: Fixed Annuities vs Certificates of Deposit (CDs)

What are the main differences between fixed annuities and CDs?

Fixed annuities and CDs both offer guaranteed interest and principal protection. But annuities usually allow tax-deferred growth, longer terms, income options, while CDs are bank products with set fixed terms and tax on interest each year.

How does tax treatment differ?

With a fixed annuity, earnings grow tax-deferred until withdrawals. CD interest is taxed in the year it’s earned, regardless of whether you withdraw or not.

What about liquidity and penalties?

CDs often have early withdrawal penalties, but usually modest. Fixed annuities have surrender periods and charges if you withdraw early. Some annuities allow a percentage of account value each year free of charge.

Which tends to offer higher interest rates?

Fixed annuities often have higher rates than CDs, especially for longer-term guarantees, because insurance companies commit to longer holding and can invest in long-term fixed income.

When might a CD be the better option?

CDs are often better if you need short-term savings, easy access to your money, guarantee via FDIC/NCUA, or you’re saving for a near-term goal and can’t lock up funds long.

What are the risks with fixed annuities?

Risks include insurer credit risk, surrender charges, potential tax penalties for early withdrawals, inflation erosion if not adjusted, and being locked into terms that may underperform during rising rate periods.