Economic downturns are unpredictable—your retirement security doesn’t have to be.

Market volatility, inflation, and global uncertainty can make it feel like your financial future is at risk. But with the right strategy, you can take control. By diversifying your income sources, protecting your savings from losses, and planning ahead, you can build a retirement that’s resilient no matter what the economy throws your way.

One of the most effective ways to safeguard your nest egg is by using fixed and indexed annuities that offer guaranteed growth and principal protection. These products allow you to grow your money without exposure to market risk—while locking in competitive interest rates that outperform most bank CDs or savings accounts.

At Diversified Insurance Brokers, we help clients secure rates as high as 6.15% with no market exposure and full protection of principal. Whether you’re nearing retirement or already there, we’ll guide you toward solutions designed to deliver peace of mind and predictable income.

Now is the time to future-proof your finances—before the next downturn.

How To Protect Your Retirement From the Next Recession

When a recession strikes, it affects more than just the stock market. During the Great Recession (December 2007 to June 2009), Americans lost over $16 trillion in net worth. Unemployment jumped by 4.5 percentage points, 8.7 million jobs vanished, and home prices plummeted by 33%—devastating those who planned to use real estate or investment accounts to fund retirement.

For those in or near retirement, the idea of another downturn can spark serious anxiety. A sharp drop in portfolio value, reduced income, or a delayed retirement date can derail your long-term plans—unless you’ve taken steps to prepare.

While economic cycles are unpredictable, your retirement income doesn’t have to be.

At Diversified Insurance Brokers, we help our clients build recession-resistant retirement plans that prioritize guaranteed income, principal protection, and tax-efficient growth—no matter what happens in the market.

Here are a few strategies we use to help protect your nest egg:

-

Shift a portion of your assets to fixed or indexed annuities with guaranteed interest and downside protection

-

Create multiple income streams so you’re not dependent on any single investment

-

Preserve cash reserves and reduce unnecessary risk exposure

-

Align your timeline with predictable sources of income like Social Security, pensions, and annuity payouts

One of the most powerful tools we offer is a fixed annuity. With rates as high as 6.15%, these solutions can protect your principal and provide reliable growth—even if the market tanks.

A recession may be out of your control—but your retirement plan doesn’t have to be.

Let us help you build a buffer against the next downturn.

📞 Call us at 770-662-8510

📅 Schedule a free consultation: Book with Jason

Or visit our Contact Page: https://www.diversifiedquotes.com/contact-us/

-

A strong retirement plan starts with understanding where your income will come from—and how reliable it is. Review all guaranteed sources of income such as Social Security, pension payments, and annuities, which provide predictable cash flow no matter what happens in the market. These income streams act as a financial anchor during turbulent times, helping you maintain confidence and control even in a recession. Consider incorporating or increasing annuity-based income to add long-term stability to your retirement strategy.

Schedule an appointment with a Social Security Expert here.

Take Control of Your Retirement Future

Economic uncertainty doesn’t have to derail your retirement. With the right strategy and guidance, you can build a financial plan that stands strong—no matter what the market does. By taking a proactive approach now, you’ll gain confidence, clarity, and control over your future.

At Diversified Insurance Brokers, we specialize in recession-ready retirement strategies that protect your income, grow your savings, and give you lasting peace of mind.

Ready to secure your future?

📞 Call us at 770-662-8510

📅 Schedule your free consultation: Book with Jason

Or visit our Contact Page: https://www.diversifiedquotes.com/contact-us/

📈 Want to See Today’s Top Annuity Rates?

Explore the most competitive fixed and bonus annuity rates available now.

👉 Check Current Annuity Rates

No Obligation Consultation

Protect Your Retirement Nest Egg with a Fixed Annuity Strategy

Safeguarding your retirement savings is one of the most important steps you can take to ensure long-term financial security. Fixed annuities offer a powerful way to protect your principal, avoid market volatility, and create a reliable income stream you can’t outlive. Whether you’re looking to grow your nest egg conservatively or lock in guaranteed lifetime income, the right annuity strategy can help preserve what you’ve earned and provide lasting peace of mind.

Let’s explore the options that align with your goals. Contact us today to build a personalized plan with the experts at Diversified Insurance Brokers.

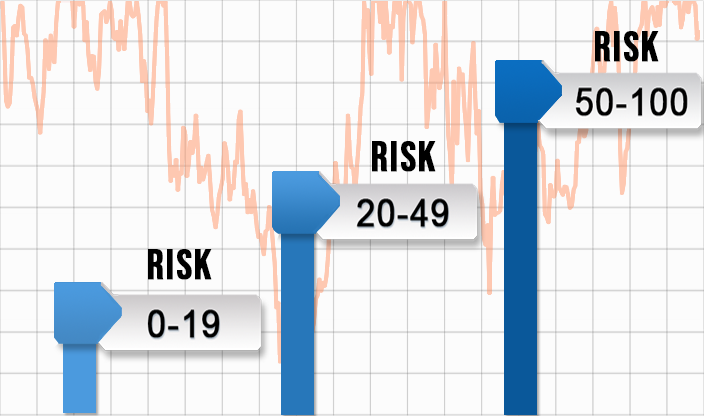

Discover Your Portfolio Risk—Before the Market Does

Use our Risk Analyzer Tool to uncover hidden vulnerabilities in your current portfolio. Don’t assume your investments are safe—learn your true risk tolerance and take control. Gain clarity, reduce exposure, and protect your retirement from unnecessary market losses.